What is one main difference between saving and investing?

Key takeaways

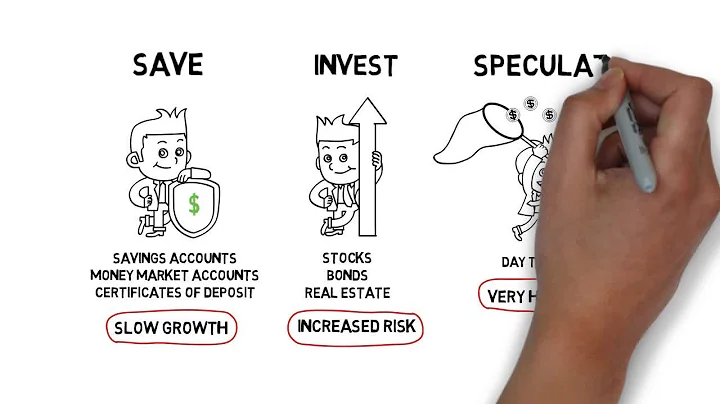

What is the difference between saving and investing? Saving you are putting money away to keep and use later. Investing you are putting money in, hoping that it will increase.

Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals. However, investing also comes with the risk of losing money.

The key difference is this: When you save money, you're putting your money somewhere safe to use for the future, often for short-term goals. Alternatively, when you invest money, you accept a greater potential risk in return for a greater potential reward. Investing often makes more sense for long-term goals.

Teaching Kids About Investing

Depending on their maturity level and interests, some kids might enjoy following investments as early as grade school or middle school. The key difference between saving and investing is that money saved grows at a more predictable rate than money invested.

Saving guarantees you the money you put away while investing has no guarantees.

Investing means taking some risk and buying assets that will ideally increase in value and provide you with more money than you put in, over the long term. And while saving offers a guaranteed return (that is, interest on your balance), investing includes the potential to lose money.

Savings account balances have no risk of declining. Plus, FDIC insurance protects your money in the unlikely event that your bank or credit union goes under. Higher risk. When investing, you could lose money, break even, or earn a return—there are no guarantees.

Saving is a safer option than investing as you have full control of your finances. You may earn a little more based on your savings interest rate, but you should never find fewer funds than you put in.

By definition, saving is income minus spending. Investment refers to physical investment, not financial investment. That saving equals investment follows from the national income equals national product identity.

Which comes first investing or saving?

Saving is ultimately the first step to investing because, without it, you're not ready to take on the risk of putting your money in the market. To make sure you are earning the greatest return on your savings, especially when you are relying on it as an emergency fund, use a high-yield savings account.

Investing is riskier than saving, but can also earn higher returns over the long term. Even accounting for recessions and depressions, the S&P 500 (composed of the U.S.'s 500 largest companies) has averaged just over 11 percent per year in returns since 1980.

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings. The savings category also includes money you will need to realize your future goals. Let's take a closer look at each category.

The biggest difference between saving and investing is the level of risk taken. Saving typically results in you earning a lower return but with virtually no risk. In contrast, investing allows you the opportunity to earn a higher return, but you take on the risk of loss in order to do so.

One should save around 10 per cent of one's income every month and put aside 10 to 15 per cent of income into investments. While savings are for the short-term, investments should be on long-term basis as they help you grow your wealth to meet some life goals.

When planned savings is less than the planned investment , then the planned inventory rises above the desired level which denotes that the consumption is the economy was less then the expected level which indicates at less aggregate demand in comparison to aggregate supply.

Explanation: A key difference between saving and investing is that saving is for emergencies and goals, while investing is for long-term wealth. Saving is typically done to set aside funds for unexpected expenses or to achieve specific financial goals, such as buying a house or funding education.

Save: This is a short-term goal; many savings products have low risks and can give you easy access to the money. Build wealth over your lifetime. Invest: This is a long-term goal for which the money won't be needed soon; taking some risk may mean a higher return. Answers will vary.

Imagine you wish to amass $3000 monthly from your investments, amounting to $36,000 annually. If you park your funds in a savings account offering a 2% annual interest rate, you'd need to inject roughly $1.8 million into the account.

Similarities between saving and investing

Both build wealth over time. A healthy financial strategy leans on both for a sound financial future. Both investing and saving require putting your money into a financial institution. For saving, that's a savings account at a bank.

Should I pull money out of bank?

As long as your deposit accounts are at banks or credit unions that are federally insured and your balances are within the insurance limits, your money is safe. Banks are a reliable place to keep your money protected from theft, loss and natural disasters. Cash is usually safer in a bank than it is outside of a bank.

The simple rule: If you need the money in the next three years, then save it ideally in a high-yield savings account or CD. If your goal is further out, or you don't have a specific need for the money, then start thinking about investing in something that will grow more, like stocks or bonds.

Cash and cash equivalents can provide liquidity, portfolio stability and emergency funds. Cash equivalent securities include savings, checking and money market accounts, and short-term investments. A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio.

As you saw, investing once a month gets you all the goodies. Plus, most people have a monthly income cycle, so monthly SIPs perfectly gel with that frequency. So, by all means, you can go for monthly SIPs, as the above data shows that daily or weekly SIPs don't enhance your returns significantly.

Business risk may be the best known and most feared investment risk. It's the risk that something will happen with the company, causing the investment to lose value. These risks could include a disappointing earnings report, changes in leadership, outdated products, or wrongdoing within the company.

References

- https://www.unionbankofindia.co.in/english/ultimate-guide-to-savings-accounts.aspx

- https://www.ithinkfi.org/blog/blog-detail/ithink-blog/2024/01/03/saving-vs.-investing-elevate-your-financial-game-with-ithink-financial!

- https://www.experian.com/blogs/ask-experian/how-compound-interest-works/

- https://www.cnbc.com/select/checking-vs-savings/

- https://study.com/academy/lesson/what-are-compound-words-meaning-examples.html

- https://www.forbes.com/advisor/in/banking/what-is-savings-account/

- https://www.synchronybank.com/blog/simple-vs-compound-interest-savings-calculations/

- https://www.wsj.com/buyside/personal-finance/saving-vs-investing-01657732972

- https://bankmas.co.id/en/blog/kelebihan-menabung-di-bank/

- https://www.investopedia.com/terms/p/payyourselffirst.asp

- https://www.affinityfcu.com/financial-wellbeing/blog/personal-banking/investing-vs-saving-key-differences-and-why-your-money-mindset-matters

- https://www.thebalancemoney.com/simple-interest-overview-and-calculations-315578

- https://www.albany.edu/~bd445/Economics_301_Intermediate_Macroeconomics_Slides_Spring_2014/Saving_Equals_Investment.pdf

- https://quizlet.com/214272983/unit-5-personal-finance-flash-cards/

- https://www.axisbank.com/business-banking/current-account/advantage-current-account

- https://www.investopedia.com/terms/c/compounding.asp

- https://homework.study.com/explanation/which-of-the-following-is-not-a-benefit-of-a-savings-account-a-a-way-to-achieve-short-term-savings-goals-b-build-funds-for-large-irregular-expenses-c-protection-against-inflation-d-a-way-to-save-for-your-child-s-education.html

- https://www.cbsnews.com/news/how-much-you-can-make-depositing-10000-into-high-yield-savings-account/

- https://quizlet.com/442558382/savings-accounts-flash-cards/

- https://www.diffen.com/difference/Compound_vs_Element

- https://files.consumerfinance.gov/f/documents/cfpb_building_block_activities_comparing-saving-investing_guide.pdf

- https://www.investopedia.com/terms/c/compoundinterest.asp

- https://srfs.upenn.edu/financial-wellness/blog/power-compound-interest

- https://dictionary.cambridge.org/us/dictionary/english/compound-interest

- https://www.commbank.com.au/articles/youth-student-banking/how-to-explain-interest-to-kids.html

- https://unacademy.com/content/ssc/study-material/mathematics/real-life-applications-of-compound-interest/

- https://mathspace.co/textbooks/syllabuses/Syllabus-1078/topics/Topic-20935/subtopics/Subtopic-271344/

- https://www.cnbc.com/select/bank-of-america-advantage-savings-review/

- https://chem.libretexts.org/Bookshelves/Introductory_Chemistry/Introductory_Chemistry/03%3A_Matter_and_Energy/3.04%3A_Classifying_Matter_According_to_Its_Composition

- https://quizlet.com/471265284/personal-finance-flash-cards/

- https://thirdspacelearning.com/gcse-maths/number/simple-interest/

- https://testbook.com/maths/compound-interest

- https://www.americancentury.com/insights/kids-guide-to-saving-spending-investing/

- https://www.embers.org/calculator/simple-vs-compound-interest-calculator

- https://www.hdfclife.com/insurance-knowledge-centre/investment-for-future-planning/importance-of-savings-and-investments

- https://www.dummies.com/article/business-careers-money/business/accounting/general-accounting/how-to-calculate-simple-and-compound-interest-175432/

- https://quizizz.com/admin/quiz/633b038b5f1ff9001e7934e4/ramsey-classroom-chapter-4-study-guide

- https://education.jlab.org/qa/compound.html

- https://www.ent.com/education-center/smart-money-management/what-is-compound-interest/

- https://www.shawbrook.co.uk/savings/monthly-interest-savings-accounts/

- https://brainly.com/question/47001084

- https://byjus.com/maths/difference-between-simple-interest-and-compound-interest/

- https://www.calculator.net/compound-interest-calculator.html

- https://www.consumerfinance.gov/ask-cfpb/how-does-compound-interest-work-en-1683/

- https://www.nerdwallet.com/article/banking/is-my-money-safe-in-a-bank

- https://www.odinmortgage.com/resources/compound-interest-on-mortgage/

- https://www.investopedia.com/articles/personal-finance/082115/simple-interest-loans-do-they-exist.asp

- https://web.stevenson.edu/mbranson/m4tp/version1/payday-loans-interest.html

- https://www.investopedia.com/articles/investing/022516/saving-vs-investing-understanding-key-differences.asp

- https://www.bankrate.com/banking/what-is-compound-interest/

- https://study.com/academy/lesson/how-to-find-simple-interest-rate-definition-formula-examples.html

- https://www.merriam-webster.com/dictionary/compound

- https://www.investopedia.com/articles/personal-finance/101315/4-ways-simple-interest-used-real-life.asp

- https://www.republicbank.com/personal/personal-savings/advantage-savings/

- https://byjus.com/question-answer/compound-interest-is-always-greater-than-or-equal-to-simple-interest-true-false/

- https://www.ayco.com/insights/articles/saving-vs-investing-what-is-the-difference.html

- https://thirdspacelearning.com/us/math-resources/topic-guides/ratio-and-proportion/simple-interest/

- https://www.westernsouthern.com/investments/how-does-compound-interest-work

- https://www.fortunebuilders.com/simple-vs-compound-interest/

- https://www.iciciprulife.com/protection-saving-plans/importance-of-savings.html

- https://www.nerdwallet.com/article/banking/saving-vs-investing-when-to-choose-how-to-do-it

- https://www.cnbc.com/select/money-market-account-vs-high-yield-savings-account/

- https://www.investopedia.com/articles/investing/020614/learn-simple-and-compound-interest.asp

- https://collegesteps.wf.com/compounding-interest-explained/

- https://www.cnbc.com/select/saving-vs-investing/

- https://www.abc.net.au/news/2023-04-22/compounding-interest-beat-the-bank-paying-extra-mortgage/102248130

- https://www.turito.com/blog/one-on-one-online-tutoring/what-is-a-compound-sentence-examples

- https://milestone.sg/blog/teaching-your-kids-the-magic-of-compounding/

- https://www.forbes.com/advisor/banking/atm-withdrawal-limits/

- https://www.toppr.com/ask/question/when-planned-saving-is-less-than-planned-investment-it-indicates-a-situation-when/

- https://homework.study.com/explanation/is-saving-good-or-bad.html

- https://www.investopedia.com/chase-savings-account-interest-rates-7566583

- https://mint.intuit.com/blog/money-etiquette/simple-vs-compound-interest/

- https://infinitylearn.com/surge/question/economics/what-do-people-do-with-extra-cash/

- https://www.bajajhousingfinance.in/how-to-calculate-home-loan-interest-rate

- https://study.com/academy/lesson/what-are-elements.html

- https://www.investopedia.com/articles/personal-finance/061615/how-interest-rates-work-car-loans.asp

- https://www.collinsdictionary.com/dictionary/english/compound-interest

- https://www.motilaloswal.com/article-details/pros-and-cons-of-compound-interest/5400

- https://homework.study.com/explanation/which-statement-best-describes-a-compound-a-a-mixture-of-atoms-b-a-mixture-of-more-than-one-element-c-a-material-that-is-made-up-of-a-combination-of-atoms-bonded-together-d-a-material-that-is-made-up-of-a-single-type-of-atom-e-none-of-the-above.html

- https://www.schwab.com/learn/story/young-investors-401k-savings-and-compound-interest

- https://www.investopedia.com/ask/answers/12/safest-place-for-money.asp

- https://moneysmart.gov.au/saving/compound-interest

- https://www.investopedia.com/terms/s/simple_interest.asp

- https://www.centralbank.net/learning-center/what-is-compound-interest-and-why-its-important/

- https://www.firstrepublic.com/insights-education/simple-vs-compound-interest-an-easy-guide

- https://www.unfcu.org/financial-wellness/50-30-20-rule/

- https://www.rebalance360.com/the-power-of-compounding/

- https://www.securian.com/insights-tools/articles/how-compound-interest-works.html

- https://www.paisabazaar.com/home-loan/interest-rates/

- https://quizlet.com/42571685/savings-account-terms-and-definitions-flash-cards/

- https://www.usnews.com/banking/articles/credit-union-vs-a-bank

- https://haw.bhusd.org/ourpages/users/jschmidt/Worksheets/Seventh%20Grade/comp_int_ws_7.pdf

- https://www.usbank.com/investing/financial-perspectives/investing-insights/percentage-of-cash-in-my-portfolio.html

- https://moneyview.in/savings-account/cash-deposit-limit-in-saving-account-as-per-income-tax

- https://www.fool.com/investing/how-to-invest/stocks/simple-interest-vs-compound-interest/

- https://www.calculator.net/simple-interest-calculator.html

- https://byjus.com/maths/compound-interest/

- https://quizizz.com/admin/quiz/5f9999ace09ce0001b61f302/unit-6-test-investing

- https://sbi.co.in/web/personal-banking/accounts/saving-account/savings-bank-rulesabridged

- https://www.bankrate.com/investing/saving-vs-investing/

- https://smartasset.com/investing/difference-between-simple-and-compound-interest

- https://fortune.com/recommends/banking/saving-vs-investing/

- https://roostermoney.com/talking-about-interest/

- https://www.cancer.gov/publications/dictionaries/cancer-terms/def/compound

- https://www.investopedia.com/ask/answers/042315/what-difference-between-compounding-interest-and-simple-interest.asp

- https://www.forbes.com/advisor/investing/compound-interest/

- https://talkmarkets.com/content/how-much-money-do-i-need-to-invest-to-make-3000-a-month?post=431352

- https://www.moneylion.com/learn/is-saving-and-investing-same-thing/

- https://www.idfcfirstbank.com/finfirst-blogs/personal-loan/what-is-simple-interest

- https://manoa.hawaii.edu/exploringourfluidearth/chemical/chemistry-and-seawater/atoms-molecules-and-compounds

- https://www.pbs.org/video/compounds-compound-basics-uq6pkj/

- https://www.co-operativebank.co.uk/tools-and-guides/savings/how-to-pay-money-into-a-savings-account/

- https://www.moneygeek.com/financial-planning/compound-interest-for-kids/

- https://www.investopedia.com/financial-edge/0812/5-investing-risk-factors-and-how-to-avoid-them.aspx

- https://www.etmoney.com/learn/mutual-funds/which-is-better-daily-or-weekly-or-monthly-sip/

- https://chem.libretexts.org/Bookshelves/General_Chemistry/Map%3A_Chemistry_-_The_Central_Science_(Brown_et_al.)/01%3A_Introduction_-_Matter_and_Measurement/1.02%3A_Classification_of_Matter

- https://www.coursesidekick.com/economics/554118

- https://www.debt.org/advice/compound-interest-how-it-works/

- https://www.unomaha.edu/college-of-business-administration/center-for-economic-education/teacher-resources/6-8/mm-interesting.pdf

- https://www.schwabmoneywise.com/essentials/benefits-of-compound-growth

- https://www.cnn.com/cnn-underscored/money/best-compound-interest-accounts